Does mis-selling apply to lease purchase or hire purchase, or just PCP?

Guide 17 November 2025 | Chris Roy |

Updated: 17 November 2025

Originally Published: 23 June 2025

As the car finance scandal continues to unfold, many drivers are asking a simple question. Does mis-selling only apply to Personal Contract Purchase (PCP), or are Hire Purchase (HP) and Lease Purchase deals included as well?

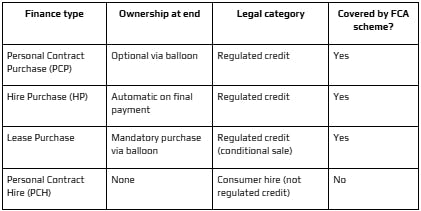

The short answer is yes. PCP and HP claims are covered by the FCA’s redress scheme, and in most cases Lease Purchase agreements are also included. Lease Purchase contracts are usually structured as conditional sale agreements, which makes them regulated credit agreements. That means they fall within the scope of the FCA’s approach to car finance claims.

There is one important exception. Personal Contract Hire (PCH) is a hire arrangement, not a credit agreement, and it does not end in ownership. PCH does not qualify for the FCA’s redress scheme.

This guide explains which products are included, how mis-sold and PCP car finance is being addressed, why mis-sold HP car finance matters just as much as PCP claims, and what to do if you think your agreement was unfair.

Understanding PCP, HP, and Lease Purchase

Car finance products can look similar at a glance. The detail that really matters is the legal structure and whether the agreement is regulated credit. That is what determines whether you can make a claim.

1) Personal Contract Purchase (PCP)

PCP spread the cost of a car with lower monthly payments. At the end, you can pay a final balloon to keep the vehicle or hand it back. PCP is a regulated credit agreement under the Consumer Credit Act. It sits squarely within the FCA’s redress framework for mis-sold car finance [1].

Most PCP claims arise from undisclosed or poorly explained commission. Many customers were not told that a dealer could influence their interest rate in a way that increased commission. That lack of transparency often led to overpayment.

Included in the FCA scheme.

2) Hire Purchase (HP)

With HP, you pay set monthly instalments and become the legal owner once the final payment is made. HP is also regulated credit. The same rules about fairness and disclosure apply, which is why HP claims are part of the FCA’s approach to car finance claims.

A lot of mis-sold HP car finance involves the same issues seen in PCP. Customers were not told about commission, were offered only one lender, or felt pushed to sign without a clear explanation of cost.

Included in the FCA scheme.

3) Lease Purchase

Despite the name, Lease Purchase is not a lease in the rental sense. You commit from the start to buy the car by paying a final balloon at the end. There is no option to walk away. Legally, this is a conditional sale agreement, which means regulated credit.

Because Lease Purchase is a form of conditional sale, it is treated in the same way as other regulated credit products for redress purposes. If the agreement was for personal use, or for a sole trader or small partnership under £25,000, it normally qualifies.

Included in the FCA scheme.

4) Personal Contract Hire (PCH)

PCH is a long term rental. You pay to use the car, return it at the end, and never own it. PCH is a consumer hire agreement, not regulated credit, and sits outside the Consumer Credit Act mechanisms used for redress.

Excluded from the FCA scheme.

Which Car Finance Agreements Are Covered?

Why PCP and HP were central to the car finance scandal

From 2007 to 2021, many dealers used commission models that rewarded higher interest rates. Customers often believed their APR reflected risk and lender policy, when in reality a sales commission could be influencing it. The FCA later banned discretionary commission for new agreements in 2021 [2], but the historical impact still matters.

That is why PCP and HP claims are now so important. The same pattern appeared across both products, and in many Lease Purchase agreements too. The FCA has paused final decisions while it builds a consistent, industry wide approach that treats customers fairly. This is the context for today’s car finance claims.

Who can make a car finance claim

You may be eligible if:

- You had a PCP, HP, or Lease Purchase agreement between 6 April 2007 and 1 November 2024

- The vehicle was for personal use, or you were a sole trader or small partnership with credit under £25,000

- You were not told about dealer commission, or how it could affect your interest rate

- You were offered only one lender or felt pressured to sign quickly

- Your interest rate seemed high compared with your credit profile

You can claim even if you have paid off the finance, sold the car, or it was repossessed. Interest free deals are usually not eligible, as there is no overpayment to car finance refund.

The FCA timeline you should know

- Consultation period runs to 12 December 2025 [3]

- Pause on final complaint responses is expected to end on 4 December 2025 [4]

- Final rules are due early 2026

- Lenders must issue final responses by 31 July 2026

- First payments are expected from late 2026

If you are asking how long do car finance claims take, most decisions for commission related cases will arrive between December 2025 and July 2026, with payments following afterwards. That timing applies across PCP claims, HP claims, and qualifying Lease Purchase complaints.

How to start a claim now

You do not need to wait for the final rules to begin. Complaints made today are logged and carried forward into the new framework.

Step 1. Gather what you have

- Vehicle registration, lender and dealer names, agreement dates and type

- Any emails, welcome packs, credit reports, or bank statements showing payments

Step 2. Write a short, clear complaint

- State that you were not told about commission or how it affected your rate

- Include your name, contact details, and car information

- Ask for a full review and a refund of any overpaid interest or undisclosed commission

Step 3. Send it to the lender

- You should receive an acknowledgement within a few weeks

- Final responses are paused until December 2025, but your case remains active

Step 4. Keep a record

- Save copies of everything you send and receive

- Your case should move into active review once the FCA confirms its rules in early 2026

If you prefer, an FCA authorised representative like a claims management company can help you manage documents and timelines, especially if you held several agreements or no longer have your paperwork.

How much compensation could you receive

Indicative figures reported in the industry suggest total redress could run into several billions across the market, with an average refund often quoted at around £700 per eligible agreement [5]. Your amount depends on the size of the loan, the level of commission, the length of the agreement, and whether you had multiple agreements.

Why it is worth acting now

Some drivers plan to wait until 2026. In practice, starting now is better. Early complaints are logged, your evidence is preserved, and you avoid the surge that will arrive once decisions restart. This applies equally to mis-sold HP car finance, PCP claims, and Lease Purchase complaints.

In summary

The FCA’s scheme for car finance claims is not only about PCP. Hire Purchase is fully included, and most Lease Purchase agreements qualify because they sit within regulated credit as conditional sale. Only PCH is excluded, since it is a rental with no ownership.

If you believe you were affected by mis-sold car finance, including mis-sold HP car finance, you can submit your complaint now. With consultation running until December 2025 and outcomes from 2026, getting your claim in early gives you the best chance of a smooth review when lenders begin issuing final responses.

_________

References:

- FCA’s redress framework for mis-sold car finance - https://www.fca.org.uk/news/statements/fca-consults-motor-finance-compensation-scheme

- The FCA later banned discretionary commission for new agreements in 2021 - https://www.fca.org.uk/publication/consultation/cp24-15.pdf

- Consultation period runs to 12 December 2025 - https://www.fca.org.uk/news/statements/motor-finance-compensation-scheme-consultation-progress-and-timing

- Pause on final complaint responses is expected to end on 4 December 2025 - https://www.fca.org.uk/news/statements/firms-given-until-december-2025-respond-motor-finance-commission-complaints

- an average refund often quoted at around £700 per eligible agreement - https://www.fca.org.uk/news/press-releases/14m-unfair-motor-loans-compensation-proposed-scheme